What are intercompany charges?

Here at Mayday we’re committed to making real-time accounting possible for finance teams. Right now, there is a lot of manual work to be done at month end which gets in the way of creating business insights and management information. For multi-entity businesses, a large part of the month end workload comes from intercompany charges.

If you need help understanding the world of intercompany charges, don’t fear! Read on to find out exactly what intercompany charges are.

What are intercompany charges?

What are intercompany charges, known by some as recharges, oncharges or intra-group charges? They occur when multiple business entities, usually companies, are connected by shareholding and form a corporate group. Those entities can be in the same country, or different ones.

Although they are related, each entity files accounts, pays tax and has employees as an individual business. It is essential that they each make the correct amount of profit or loss so that:

- They comply with the relevant accounting standards and their accounting is accurate - costs being incurred by the entity that has enjoyed the benefit; revenues being earned by the entity that has generated the value;

- The right amount of tax is paid - both corporate income tax and applicable sales taxes;

- The performance of the entity, its management and team can be accurately assessed.

The problem is that in a corporate group, things can get messy. Practical convenience can trump accounting accuracy. Costs end up being incurred by one entity that are for the benefit of another group entity. Transactions between group entities for the supply of goods or services take place at a certain cost (or no cost) when they should take place at a different arm’s length (what unrelated third parties would do) price.

Intercompany charges are how this mess gets cleaned up. They are the invoices that get raised between the related entities so that the right costs and revenues end up in the right places within the corporate group.

There are two categories of intercompany charge:

1. Costs incurred by one related entity, some or all of which is for the benefit of another group entity

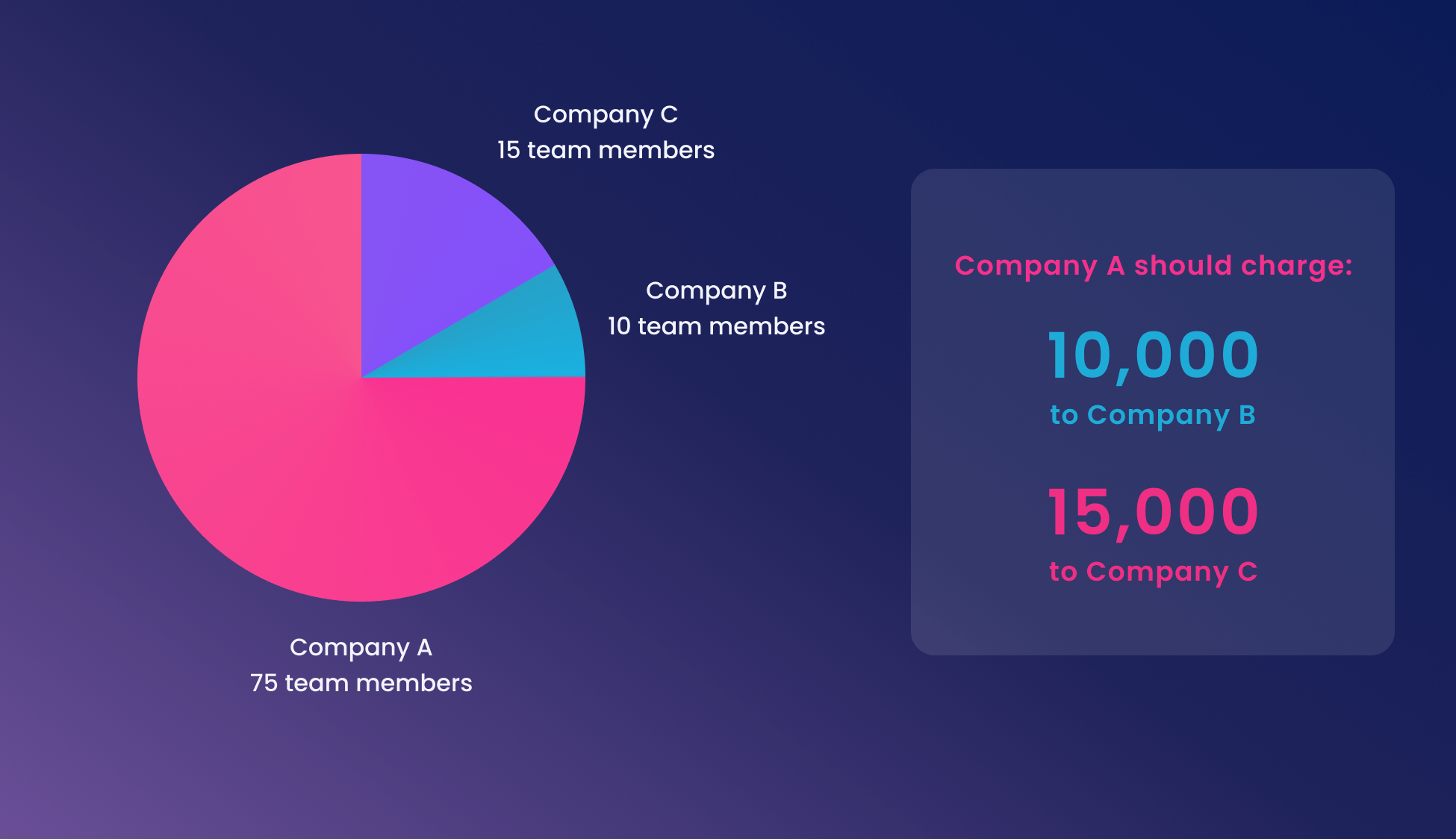

Company A pays 100,000 for the group’s Salesforce licence. It makes sense to only have one subscription as a group to maximise volume discounts. This subscription covers the use of Salesforce by 100 team members within the corporate group. 75 of those team members work for Company A. But 10 work for Company B and 15 for Company C.

Company A should recharge 10,000 (10/100) of the cost to Company B and 15,000 (15/100) to Company C.

2. To operate group's transfer pricing policy and make sure transactions between those related entities are at arm's length (what unrelated third parties would do)

These charges will take two forms:

- Cost Plus - where the costs of one group entity are marked up by a percentage and charged to another group entity

- Sales Based - a proportion of one group entity’s sales are paid to another group entity

Cost Plus

UK based Company D has a Portuguese subsidiary Company E. Company E provides software development services to Company D, with Company D owning all ensuing intellectual property. The group’s transfer pricing policy specifies that Company E should charge Company D for all of its running costs plus a mark-up of 10%.

Company E incurs 50,000 of costs in the period. It needs to charge Company D 55,000 (total costs plus 10%).

Sales Based

US based Company F has an Australian subsidiary Company G. Company G markets and sells the group’s software product, the intellectual property of which is owned and developed by Company F, to customers in Australasia. The group’s transfer pricing policy specifies that Company G should pay 40% of its sales to Company F in respect of use of the intellectual property.

Company G makes sales of 100,000 in the period. Company F needs to invoice Company G for 40,000 (40% of the sales revenue).

Intercompany charges will need to be processed once a year at a bare minimum for annual accounts and tax filings. There are many reasons why you will want to run the charges more regularly than that, ideally monthly. It is also now possible to automate your charges with our product, Mayday Recharger.